Throughout 2021, the National Association of Wholesalers-Distributors (NAW) conducted research to better understand the relationship between distributors, customers, and suppliers. Based on this research, they identified innovative ways to differentiate various disrupting forces in the industry and presented their findings and recommendations in a seven-part series.

Over the course of this year-long series, NAW covered topics such as:

Their most recent webinar hosted by Ian Heller and Jonathan Bein, Ph.D covered the topic ‘An Integrated Strategy for Distributors’ which outlined eight principles of distribution disruption. We’ve summarized these eight principles below and how they can help wholesaler-distributors remain the most effective and efficient channel in distribution.

To view the full webinar recording, click here.

Marketplaces are becoming more and more prevalent, with hundreds existing today. The B2B industry is heading towards an eventual marketplace dominated distribution model. According to Digital Commerce 360, nearly 40% of business buyers make at least 26% of all corporate purchases on Amazon Business and many industry experts predict that soon, no business will be without some form of marketplace business integration.

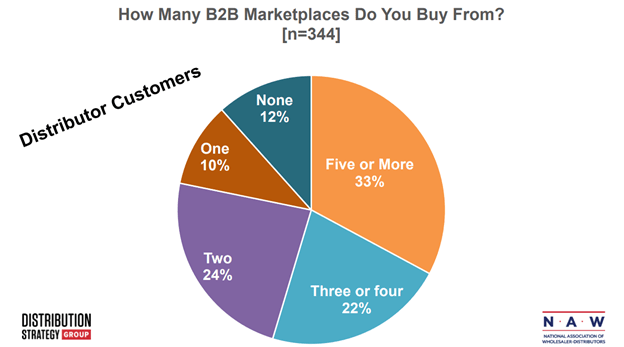

NAW conducted their own research study in 2021 and found that one-third of distributor customers are buying from five or more marketplaces, which aligns with the industry trends and predictions discussed above. They predict that pure digital distributors are eventually going to converge with digital marketplaces.

As marketplaces continue to evolve their channel, many are starting to integrate vertically to become both the seller and manufacturer. This poses a threat to both manufacturers and distributors alike and is an area that both groups need to be aware of.

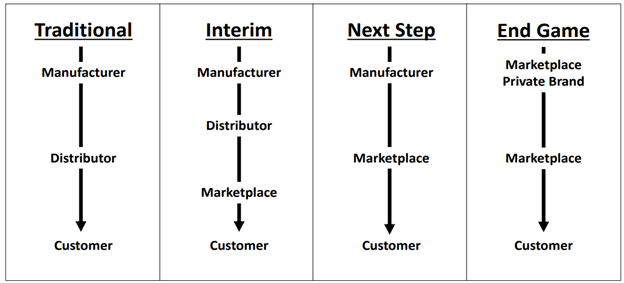

Traditionally, channels flowed from manufacturer à distributor à customer, however with the addition of marketplaces we have increased channel complexity, which created an additional step: manufacturer à distributor à marketplace à customer. Old channel rules are falling apart, and marketplaces are becoming more disruptive. In order to defend against disruptors that want to integrate vertically, manufacturers and distributors need to work together to guard their position.

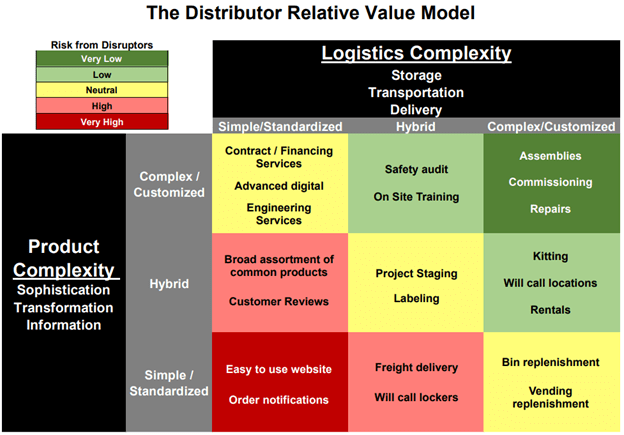

There’s a myth that exists when it comes to online sales that more is always better. If you are required to remove product or logistics complexities from your business to increase sales, you leave your company vulnerable to competition with marketplaces.

A key differentiator for distributors from marketplaces are their people and services. Sales reps, local branches, telephones services, etc. provide a personalized experience that customers become accustomed to. Complex services such as repairs, training and rentals are areas that marketplaces just can’t compete. Customers will often choose distributors with personalized services over marketplaces as they appreciate the value it brings to their business. Therefore, you should place less of an emphasis on ecommerce and continue efforts that strengthen value for customers.

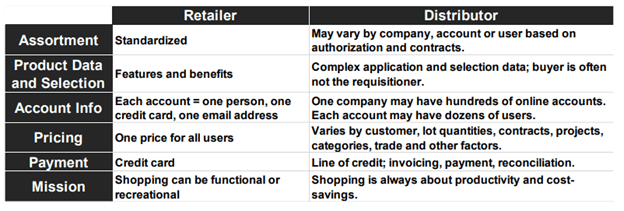

Many distributors look to shopping cart revenue as an indicator of how their website is doing, however this number can often be misleading as customers place orders in a number of different ways. B2B buyers use multiple different channels such as email, sales reps, EDI, etc. to place orders, using a distributors website merely as a source of information. In comparison to a B2C retailer, distributors are faced with more complexities around assortment, product data, account information, pricing, payment, and mission as outlined below.

Instead of focusing purely on ecommerce transactions as a measure of success, distributors should understand and perfect the two dimensions of a digital strategy, which include:

Find out what you can do to make customers jobs easier and more productive. Do your customers need sales reps? Tracking? Training resources?

Make sure that your value proposition is clear online and work towards driving digital sales through specialization.

To understand the value of your website beyond shopping cart sales, Ian recommends reaching out to 100 ecommerce purchasers every month to personally ask if they used your website in any way to make their decision. This will help you understand what areas of your website are driving value for customers apart from pure shopping cart sales.

Value-added services (VAS) as discussed above are an important differentiator for distributors today. In a survey conducted by NAW, they found that over 70% of distributors consider VAS ‘Extremely’ or ‘Very Important’ to their business.

Distribution and private-equity Veteran, outlined five key pieces of advice when it comes to establishing VAS:

Prioritizing VAS is key for distributors looking to maintain competitiveness with marketplaces today. When struggling to compete with inventory or price, services are where distributors can surge ahead.

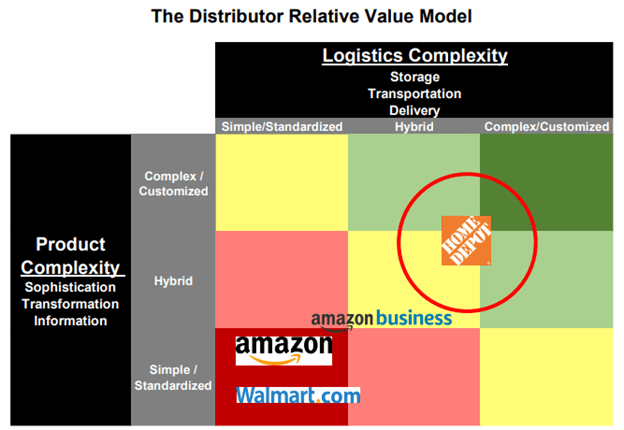

Home Depot Pro, Amazon Business and Walmart for Business are three of the top disruptors in distribution. Offering both B2B and B2C products at competitive price points makes them hard to compete with.

In 2020, Home Depot Pro experienced an unprecedented year with over $132B+ dollars in sales. This growth can be attributed to a “comprehensive ecosystem that encompasses product, exclusive brands, delivery, credit, service, digital capabilities, tool rental and more” says Home Depot CEO, Craig Menear.

While it can seem daunting to compete with the amount of product and services offerings that giants like Home Depot and Lowe’s have available, understanding how they compete and where they’re successful can help you build your strategy.

Here is a quick glance at where the competitors discussed above sit on the Distributor Relative Value Model.

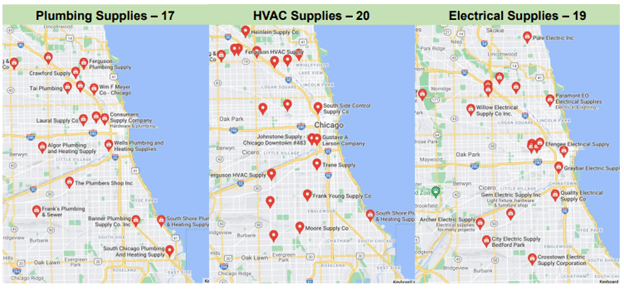

Since marketplaces are becoming ubiquitous, finding product online has become much easier. The challenge that many distributors face today is securing availability and rapid fulfillment of orders.

Big players such as Amazon, Walmart and Home Depot have set expectations high with rapid delivery methods that previously were offset by location advantage from local distributors. Today, Amazon has over 110 fulfillment centers in the United States and 400,000 drivers. These investments in massive logistics networks prove to be a threat to distributors with less resources locally and nationwide.

All of the assets that currently exist in your business have had time invested into them. Before eliminating them, do a thorough evaluation on areas of optimization. Assess current capabilities, such as:

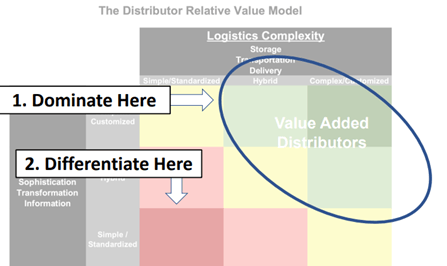

Consider and formulate your marketplace strategy by hiring experts, selling on trusted marketplaces, or building your own marketplace. Identify areas where you can differentiate and dominate – for most distributors domination areas can be found in value-added services.

These eight principles can help distribution companies add value to their business as competitiveness with marketplaces continues to rise. It is important to resist the urge to compete directly, and instead focus on strengthening the value you bring to customers through complex products and logistics.

Technology solution, such as VistaVu’s Wholesale Distribution product Resolv, can help your company achieve a fully integrated supply chain to compete with the big players. With modules like container management, vehicle routing, data messenger, warehouse management, order-to-cash and more, this comprehensive solution automates processes to help optimize the complex areas of your operations.

To learn more about Resolv, click here.

To watch a complete recording of ‘An Integrated Strategy for Distributors’ from the National Association of Wholesalers-Distributors, click here.

VistaVu creates solutions for your business.

Offices in Calgary, Houston, Dallas, Denver, & New York.

Call us at 1-888-300-2727 ext. 105