Price plays a significant role in determining an organization’s profitability and influencing customer behavior. A well-designed pricing strategy primarily affects the bottom line, but it also shapes a company’s competitive position in the market. In this article, we will explore the relationship between price and profit, discuss the application of value-based pricing and subscription pricing in relation to elastic and non-elastic prices. Additionally, we will emphasize the importance of employing sales and billing software to effectively manage sales, contracting, billing, and collection processes, regardless of the pricing strategy adopted.

To understand how price impacts profit, it is important to understand the concept of price elasticity of demand. Price elasticity measures the fluctuations in consumer demand in relation to changes in the price of a product or service. A product is considered price elastic when a slight change in price leads to a notable change in demand, while a price inelastic product experiences minimal demand change despite price fluctuations.

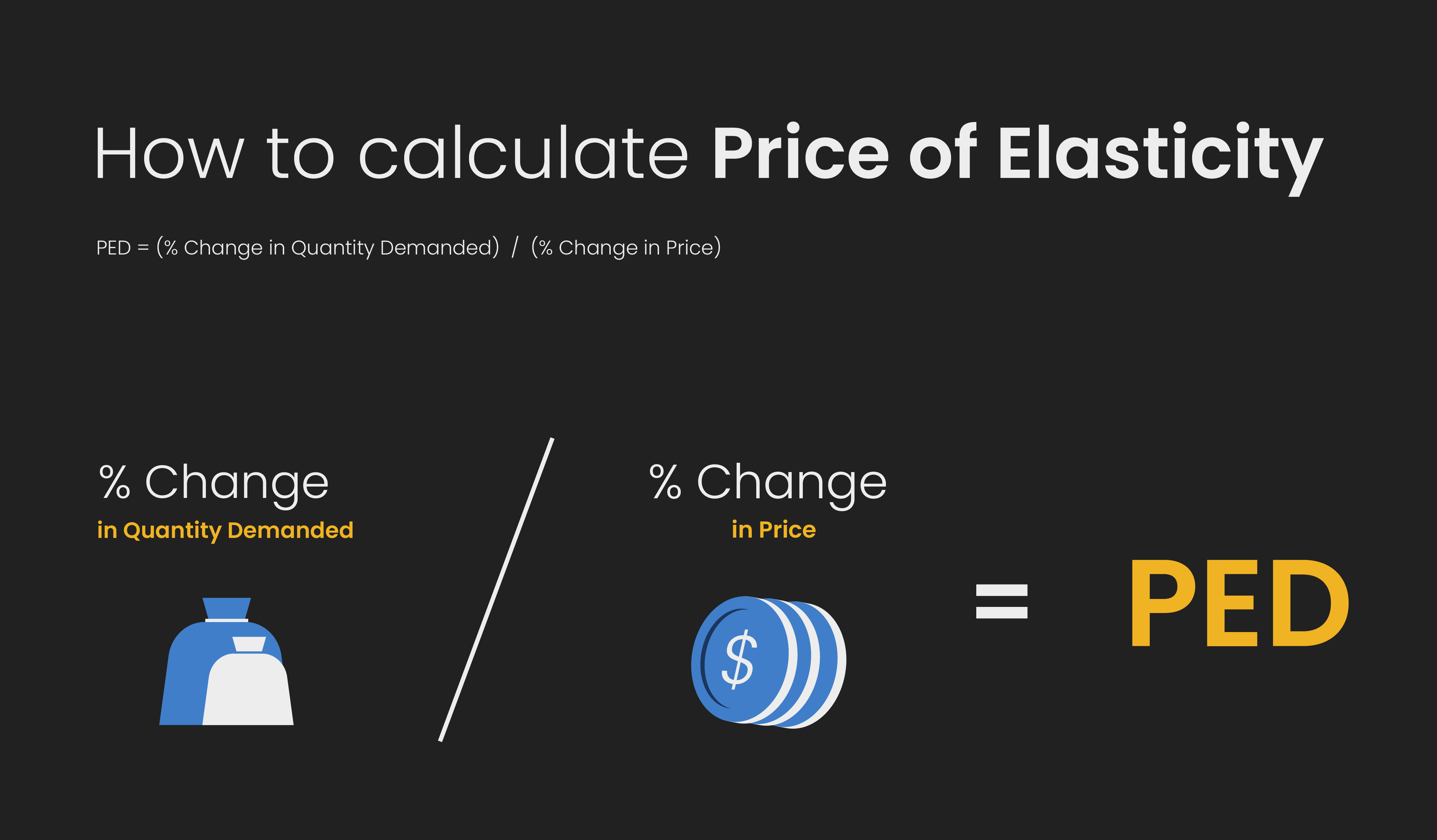

The price elasticity of demand (PED) is calculated using the formula:

When PED is less than 1, demand is price elastic; when PED is greater than 1, demand is price inelastic; and when PED = 1, demand is unit elastic.

Let us consider two pricing strategies: value-based pricing and subscription pricing, and their applicability to elastic and non-elastic prices.

Value-based pricing is a strategy that sets prices based on the perceived value of a product or service by the potential consumer. It involves aligning the price with the benefits and value that the product offers, rather than solely focusing on costs. This strategy can be applied to both elastic and non-elastic prices.

For elastic prices, value-based pricing becomes pivotal as customers are extremely sensitive to price changes. By highlighting the unique value proposition and benefits of a product or service, businesses can justify higher prices and maintain profitability. Effective communication of the value can help mitigate the negative impact of price increases on demand.

For non-elastic prices, value-based pricing allows businesses to capture the maximum value that customers are willing to pay. By understanding the customer’s perception of value and pricing the product or service can adjust accordingly, allowing organizations to optimize profitability without significantly impacting demand.

For example, consider a high-end smartphone manufacturer that implements a value-based pricing strategy. They offer a range of smartphones with advanced features, innovative technology, and superior user experience. The company conducts extensive market research to understand the perceived value of their products among consumers.

Based on their findings, they set premium prices for their smartphones, positioning them as exclusive, top-of-the-line devices for tech enthusiasts and early adopters. The company effectively communicates the unique value they intend to set for their product through targeted marketing campaigns, highlighting features such as a high-resolution display, advanced camera capabilities, and powerful processing capabilities.

Despite being in an elastic pricing environment where customers are sensitive to price changes, the value-based pricing strategy allows the company to justify the higher prices. Customers who value the advanced features and exceptional user experience are willing to pay a premium for the brand’s products, resulting in higher profit margins for the company.

Subscription pricing involves offering products or services through a subscription model, where customers pay a recurring fee for access over a specified period. This strategy is commonly applied to both elastic and non-elastic prices.

For elastic prices, a subscription model can help mitigate the negative impact of price sensitivity. By offering a lower upfront price combined with a recurring fee, businesses can reduce the perceived cost and increase the affordability, thereby attracting and retaining customers. This approach can be particularly effective in industries such as software, media streaming, and a variety of other online services.

For non-elastic prices, subscription pricing offers an opportunity to increase customer loyalty and generate recurring revenue. By providing additional value through continuous access, personalized offers, or exclusive benefits, organizations can justify higher prices and maintain profitability.

For example, subscription pricing allows organizations to consider a software-as-a-service (SaaS) company that offers project management software. They adopt a subscription pricing model to cater to both elastic and non-elastic pricing scenarios.

For elastic pricing, the company offers multiple subscription tiers, each tailored to a different customer set based on their needs and usage requirements. They provide a low-cost entry-level subscription plan with basic features, targeting price-sensitive customers who are new to project management software. This approach attracts customers who may have been deterred by higher upfront costs. As customers recognize the value of the software and their requirements grow, they can upgrade to higher-priced subscription tiers, unlocking more advanced features and functions. This strategy helps the company capture a wide range of customers, mitigating the impact of price sensitivity on demand.

For non-elastic pricing, the SaaS company introduces premium subscription plans that include advanced features, integrations with other business tools, and priority customer support. They market these plans as comprehensive solutions for enterprises and teams with complex project management needs. By providing added value and catering to specific customer segments willing to pay a higher price for enhanced capabilities, the organization can maintain profitability and generate recurring revenue from loyal customers.

Through the effective implementation of subscription pricing, the company ensures a steady stream of revenue and builds long-term customer relationships by continuously delivering value through regular software updates, new features, and customer support.

Numerous studies have demonstrated the significance of pricing strategies in determining profitability. For instance, research by McKinsey & Company found that a 1% increase in price could result in an 8% increase in operating profit, assuming no change in sales volume. This highlights the importance of carefully evaluating pricing decisions, as even minor adjustments can significantly impact an organization’s bottom line.

Regardless of the pricing strategy adopted, it is crucial to have robust sales and billing software in place to manage the sales, contracting, billing, and collection processes efficiently. Here is why:

1. Streamlined Sales Processes: Sales software enables businesses to streamline their sales processes, from lead management and opportunity tracking to quote generation and contract negotiation. This ensures that sales teams can effectively communicate pricing options, discounts, and communicate important values to customers, enhancing their understanding and acceptance of the proposed prices.

2. Accurate Contracting: Sales software helps automate the contracting process, ensuring accurate and timely creation, distribution, and management of contracts. This reduces the risk of errors, omissions, or misinterpretations in pricing terms, improving customer satisfaction, and reducing disputes related to pricing.

3. Efficient Billing and Invoicing: Billing software automates the invoicing process, enabling businesses to generate accurate and timely invoices based on the pricing agreements. It ensures that customers are billed correctly for the products or services they have acquired, including any applicable discounts, subscriptions, or usage charges. This minimizes revenue leakage and improves cash flow management.

4. Effective Collection Management: Collection management features embedded in billing software help businesses track and manage customer payments, ensuring that the amounts charged are collected on time. It provides insights into outstanding invoices, payment history, and aging reports, enabling proactive measures to be taken for efficient debt recovery and reducing the impact of late or non-payment on profitability.

5. Data Analysis and Pricing Optimization: Sales and billing software can provide valuable analytics pertaining to sales performance, revenue streams, and pricing effectiveness. By analyzing this data, businesses can gain insights into customer behavior, pricing trends, and the impact of different pricing strategies on profitability. These insights can inform future pricing decisions, allowing organizations to optimize their pricing strategies for maximum profitability.

The relationship between price and profit is complex, influenced by factors such as price elasticity of demand, market competition, consumer preferences, and pricing strategies. Employing effective sales and billing software is essential to manage sales, contracting, billing, and collection processes seamlessly, regardless of the pricing strategy adopted. By leveraging these software solutions, businesses can streamline their operations, ensure accurate pricing management, optimize revenue collection, and make informed pricing decisions to maximize profitability and maintain a competitive edge in the market.

VistaVu creates solutions for your business.

Offices in Calgary, Houston, Dallas, Denver, & New York.

Call us at 1-888-300-2727 ext. 105