The IRS has recently reintroduced Form 1099-NEC to report on nonemployee compensation. This is the first time in 38 years that business owners will be required to submit this specific form for independent contractors that satisfy these four conditions:

Thankfully, SAP Business ByDesign has implemented changes to generate both Form 1099-MISC and Form 1099-NEC. To setup the Tax Arrangement for Form 1099-NEC in your system, you must create the Tax Return, release and print the Tax Forms and generate the 1099-NEC’s Form 1096 submission file.

Watch our recorded webinar: ‘How to Set-Up and File a 1099-NEC Form in SAP Business ByDesign’ to see how to implement these new changes.

An assumption going into this process is that 1099-MISC is currently setup within your users’ SAP Business ByDesign tenant. Prior to running a withholding tax return run for 1099-NEC in SAP Business ByDesign, there are a few prerequisites that we’ve highlighted. You can click here to see our resource document on how exactly to setup each of these perquisites in your system.

First navigate to your Supplier base to choose desired supplier. From here you can edit their financial data where you will be required to input their Employer Identification Number of Social Security number under the Tax Numbers section. This is their federal ID number that will be reported on the 1099.

Under Withholding Tax Exemptions enter US, Tax Type 2 & Tax Rate Type 1. Under the Withholding Tax Income Type enter 7. The tax rate type will generally be ‘No Backup Withholdings’ unless a letter from the IRS has been received.

Next, navigate to the Tax Management Work Center and choose tax authorities. You will want to edit US Tax Authority Financial Data. Once here, validate that your company(s) are listed under Financial Data.

Navigate to Company Tax Arrangements and make sure that validate the ‘Withholding Tax Required’ is checked for your company(s). This must be checked in order for SAP Business ByDesign to collect the required information for the 1099’s.

Navigate to Tax Number subtab and verify that the company’s tax number is listed. This will print on the 1099 form in the format as listed on this screen.

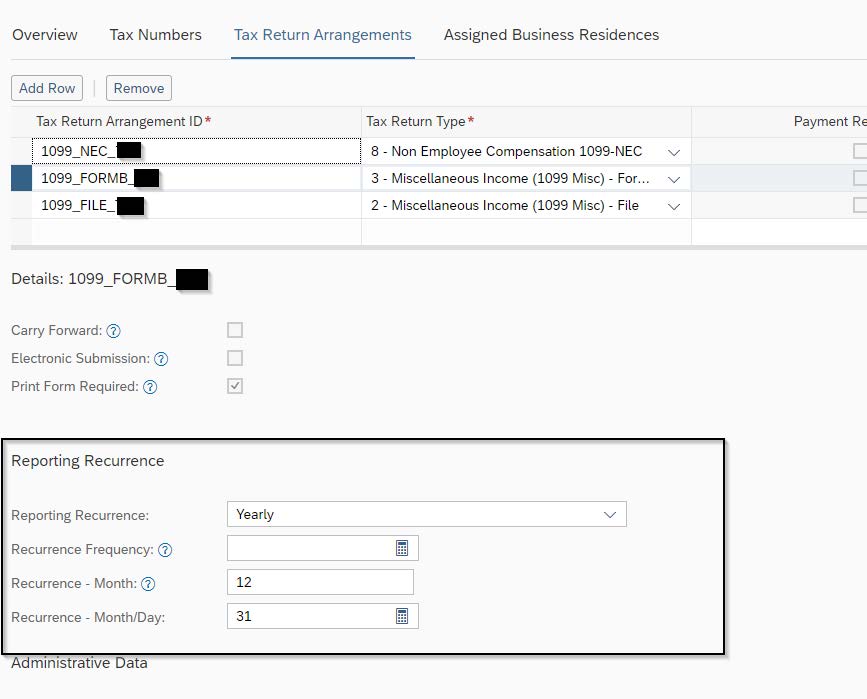

Move to the Tax Return Arrangements subtab and ensure the 3 Tax Return Arrangement ID’s [see image below] are listed. Ensure there is a Person Responsible assigned as this information will be listed on the file that goes to the IRS.

Click to view image

The settings for each Tax Arrangement ID will all be the same.

Important things to note:

You are now ready to Run a Withholding Tax Return Run for 1099-NEC’s in SAP Business ByDesign!

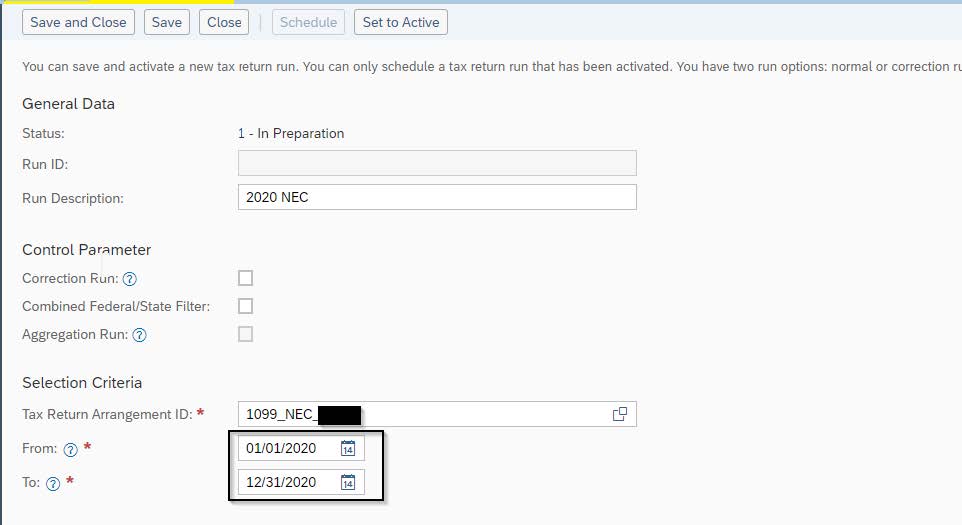

Now that all of the prerequisites have been taken care of, you are able to run the withholding tax return. First navigate to the Tax Management Work Center and choose Withholdings Tax Return Runs. Create a New Tax Return Run & enter the Run Description and Tax Return Arrangement ID.

Enter the From and To dates. This will always be dated January 1 of the tax year to December 31 of the tax year because this is an annual return.

Set to active and save and close.

Click to view image

This will then create a log with a link to the tax return.

All tax returns in preparation will be listed under the Tax Management Work Center – Withholding Tax Returns.

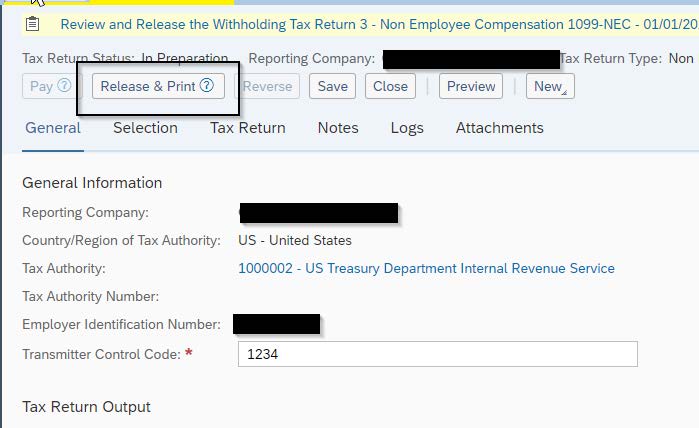

Ensure that the Transmitter Control Code that is received from the IRS is populated, as the file will not create without this TCC. This information can be found under the Tax Return ID general tab.

Navigate to the Tax Return tab and review the data. Click preview to see the 1099 NEC that can be printed. Click release and print.

Click to view image

Navigate to the Attachments Tab to see it listed. Once you click release and print the form PDF goes to Manual Print Task (unless the user is assigned to a Print Queue) and the file is under Attachments in the Tax Return.

We encourage you to download our PDF resource, How to Setup and Create Form 1099-NEC and File, to access screenshots for each of the steps listed above. Reminder that the due date for all 1099-NEC forms is January 31st 2021.

Our Manufacturing experts assess your needs and help you build a structured plan to reach business goals with technology adoption. Get in touch below.

VistaVu creates solutions for your business.

Offices in Calgary, Houston, Dallas, Denver, & New York.

Call us at 1-888-300-2727 ext. 105